As Anantha caters to children with special needs who are 6 years and above, we intend to provide services that suit their psychological, physiological and naturalistic dimensions.

Academics

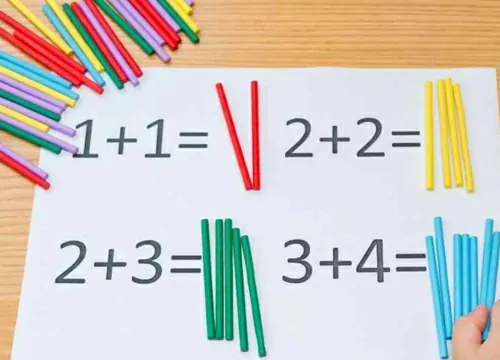

The program extends from 10 AM to 3 PM with academic sessions which include English, Math, Theme, Computers and World Affairs.

Functional

The program extends from 10 AM to 1 PM with subjects such as Functional English, Functional Math, Life skill management, Communication and Self-advocacy.

Remedial

1:1 sessions for those who learn the best when attention is not diluted. The IEP drawn out will prioritize the requirements of the child and will be planned keeping in mind the direction the child intends to take.

Extra-curricular services

For holistic development, students will have Music, Dance, Art, Theater, Sports, Gardening, Leadership and Personality growth.

Pre-vocational course

A 2 year transition course for children above 16yrs, aims at transitioning from student life to active adulthood. The curriculum aims to bridge between guided and instructional programs to self directed and self driven life. The course includes topics such as personality development, financial management, life skills management and work place readiness.

NIOS

NIOS at Anantha offers educational training to those students who have enrolled themselves with the board/programme.

The department offers services for :

- 12th grade/ Sr. Secondary : Students who are 16 years and above and have completed their secondary education with NIOS/CBSE/State/ICSE/Other will be given training for NIOS 12th examinations

- 10th grade/ Secondary : Students who are 14 years and above will be given training for NIOS 10 examinations.

- Prep : Students in the age group of 12-14 who wish to appear for Secondary and/or Sr. secondary examinations in the future will be provided with preparatory classes to familiarize themselves with the working of NIOS.